Best Health Insurance for Self-Employed Workers

Published: 26 Sep 2024

It is no contest that health insurance is paramount to each individual. However, self-employed people have a problem committing to a certain coverage, which applies to most freelancers or contracted workers. While most employees get medical insurance cover from their employers, freelancers, startups, and gig workers have to deal with the problem on their own. Healthcare costs continue to increase, making it paramount to seek a plan that suits all needs reasonably.

The practice of health insurance in self-employed workers

Health insurance is deemed a mandate for any citizen, especially for a self-employed worker. In the absence of employer-sponsored plans, an life insurance coverage needs to be procured by oneself which is a challenge. This dilemma is understandable due to the many options that one has to choose from in the market, and even the market itself has to offer. Also, insurance terms and different classifications of plans are difficult to order in one’s mind.

Why Health Insurance in For Self-Employed Workers is Crucial

Healthcare costs can be substantial and in the absence of health insurance, even a small sickness or injury can leave you in debt. There is a health insurance section that increases in subtracting these dangers by providing payments in become familiar with and learn about doctor visits, dental clinics, hospital. Furthermore, one is able to go for medical treatment when required without having to worry about the costs.

Challenges Faced by Self-Employed Workers When Choosing Insurance

Affordability is one of the most serious issues self-employed persons encounter. It is one challenge to understand the different cost options which include premiums, deductibles, copays, and out-of-pocket maximums and another one to actually land a plan that gives this coverage at an affordable price. Further, these individuals might sometimes not satisfactorily access group plans thereby relying on individual cover for their healthcare needs.

Key Considerations When Choosing Health Insurance

There is a need to be cognizant of some of the fundamentals that will guide your choice of health insurance before going into the available options for such insurance. Some premiums need to be paid as well as account for deductibles, copayments, and the extent of the network of providers available in a particular plan. When you grasp these elements, you shall become more competent in assessing plans and picking the appropriate one.

Understanding Premiums, Deductibles and Copays

- Premiums: This is the flat fee commonly referred to as the contribution that you make towards health insurance cover every month irrespective of the use of any aspect of health care services.

- Deductibles: A deductible is the figure you have to part with initially before your cover will start to pay any expenses. A high deductible plan will usually be accompanied by low monthly premiums and low deductible plans high monthly premiums.

- Copays: These are amounts of money available for this purpose after one meets certain expenditure limits as regards particular medical treatments like a physician consultation or medications availed after the fulfilment of a deductible limit.

The Significance of Coverage Networks The size of the provider network is essential when evaluating a health insurance policy. Several insurers fail to include your preferred healthcare provider in the plan’s network, which could lead to higher out-of-pocket payments or limited cover for out-of-network services.

Health Insurance Provided to the Self-Employed Health insurance cover is available to self-employed people, making it possible to further their career. Knowing these options will facilitate your proper judgment on what type of plans is appropriate for you.

Marketplace Plans Self-employed individuals can buy insurance from the Health Insurance Marketplace that is created by the Affordable Care Act. Such plans cover a wide range of services including preventive services, treatment, and drugs among others. You may also be eligible for some financial assistance to help with your monthly premiums depending on the level of your income.

Private Health Insurance Private health insurance plans are yet another option. The majority of these plans are sold outside the Marketplace, which makes them more adaptable in terms of what is covered and the network of providers. Nevertheless, they tend to be pricier than the ACA plans and do not provide as many subsidies.

Health Savings Accounts (HSAs)

Health Savings Accounts (HSAs) are plans that encourage users to save money for qualified medical expenses tax free as long as the cash remains in accounts. You have to have a high-deductible health plan (HDHP) for HSAs, but the scheme is worth it taxwise since contributions, growth and withdrawals for qualified medical expenses are not taxed.

Choose Health Insurance Plans for the Self-Employed Workers

A number of factors should be looked at before choosing a health insurance cover among them, it’s your income, health care requirements, and geographical setting. To help you make the right choice, finding the best health insurance for self-employed workers in 2024, we provide descriptions of the benefits and coverage each plan provides.

Blue Cross Blue Shield

Relations of Blue Cross and Blue Shield Association, Arizona and Texas BCBS Plans are recognized for their insurance for self employed individuals and provided with extensive coverage and network of clinician and hospitals within the United States.

- For self-employed people, BCBS – offers big range of plans from ACA compliant health plans to private insurance plans. Since a number of freelancers rely on BCBS, the latter is well reputed for its accommodation as well as all-inclusive features for all borrowed plans.

- Cost: Competitiveness of premiums including availability of subsidies for poor income ears via the marketplace will enable purchasing of Blue Cross Blue Shield.

- Preventive care services plus participation in wellness programs will also enable clients to redeem certain amounts.

- Coverage: Coverage is similarly comprehensive to include primary care physician visits, responsible for meningococcal tetravalent polysaccharide vaccine, urgent care services, primary mental health care etc.

Kaiser Permanente

Kaiser Permanente is one of the important health insurance coverage for self-employed workers in the areas where Kaiser operates. Unique about Kaiser is the presence of vertical integration, in which the two markets of insurance provision and provision of medical care are operated under one organization.

Cost: Kaiser’s plans are quite competitive with most of the options available on the Marketplace being subsidy eligible.

Coverage: Kaiser’s policies cover primary care, specialty care, hospital care and outpatient medications/drugs. One of their advantages is preventive services, which is especially good for persons seeking to be healthy at reasonable costs.

UnitedHealthcare

As one of the U.S. largest health coverage providers, UnitedHealthcare has several diverse plans for self employed people who wish to work with flexible working hours. Due to UnitedHealthcare’s vast provider network and extensive range of coverage options, it is well suited for freelancers and independent contractors.

- Cost: Multiple economical plan options are available, one of which is a High Deductible Health Plan coupled with HSA where policyholders save and deduct tax.

- Coverage: Their services cover a whole lot of health services including well woman check ups, routine and preventive services, mental health, and telehealth. UnitedHealthcare also boasts of easy to use digital tools for health management which helps users manage healthcare services.

Cigna

Self-employed persons will find that Cigna offers several benefits that rank it among the top insurers. People are able to track and manage their health care better due to Cigna’s customer service oriented approach and the digital tools as well. Most of Cigna’s plans tend to cover preventive care services such as annual check-ups and screening at no extra cost to users which motivates users to keep well.

Cost: Cigna’s premiums are reasonable but affordable for the those who do not expect to use the health plan often. There are high deductible plans that are offered which serves to lower the monthly premium payments associated with the said plans.

Coverage: Coverage comprises of rehabilitation and treatment of substance abuse and mental health disorders, and even tele medicine which is very important for the busy self-employed. Cigna has a broad and extensive provider network meaning users will have various options of access no matter the location.

Humana

Humana is an awesome company for self-employed workers who like wellness especially when self-employed. For this reason, the focus on preventive care and wellness incentives is what makes Humana unique particularly those who want to keep healthy without having to spend a fortune on healthcare. Their strateg(ies) focus on long-term health and the elimination of risks for chronic illnesses.

Cost: The majority of Humana’s plans are reasonable priced. A number of them are eligible for subsidies under ACA. There are also some plans that have low premium structures and high deductible policies.

Coverage: Separate from the general insuring of medical consultations, hospital treatments and medication coverage, Humana provides additional benefits, such as health improvement schemes or even bonuses for the correct lifestyle. They also have telehealth services, which is beneficial for independent contractors that do not have much free time.

Affordable Health Insurance options for Self-Employed Individuals

The costs of healthcare in the case of being an independent contractor can weigh heavily on one’s finances but there are ways of going around it and obtaining reasonable health care coverage without compromising on the required aspects. Here are some of the options that you can consider in health insurance providers for low-cost insurance cover.

How to Get Cheap Coverage

- Health Insurance Marketplace: The Marketplace is home to a whole spectrum of plans most of which come at different costs. The cost of premiums may also be reduced based on the people’s income due to the introduction of some subsidiaries.

- High-Deductible Health Plans (HDHPs): This type of health plan is associated with low monthly costs but with high deductibles. Using a triplet of HSAs, HDHPs and long term plans for more coverage options is also made possible this way.

Short-Term Health Insurance: These plans are intended for freelancers who may need some temporary coverage between jobs or for individuals who only require covering for a few months. These plans, however, are usually not very inclusive.

Cost-saving Strategies for Healthcare

Maximise the Usage of Preventive Care: Many plans, especially those complying with the ACA, incorporate some preventive services such as vaccines, screenings and annual checkups without additional fees. A smal health event can always be more expensive than its early treatment.

Search around for Medications: There is a great difference in how drugs are priced based on where they are purchased. Seek out lower prices, generic equivalents, and pharmacy programs.

Seek out Telemedicine Services: Nowadays, many companies offering health insurance have included telemedicine services as part of their policy where patients reach out to the doctors for healt issues which are not termendly. This may be much cheaper than walking into the doctors office.

Health Care Insurance for the self Employed

Part of the advantage of acquiring health insurance through the ACA Marketplace is that one stands a chance of getting subsidies that assist in minimizing the cost of the premiums. These subsidies are however only applicable to low-income earners and small families.

Eligibility Criteria for Subsidies

In order to qualify for the health care subsidies in the year 2024 tax year, every individual’s income has to be 100% to 400% above the federal poverty level(FPL). If your income falls in this range, then you qualify to be offered assistance of two kinds:

- Premium Tax Credits: A tax credit is issued that will decrease monthly payments owed towards a medical insurance plan for each person.

- Cost-Sharing Reductions: These reduce the out-of-pocket expenses that an insured member pays such as deductibles, copay, and coinsurance.

How to Apply for Health Insurance Subsidies

17 When it comes to applying for subsidies, the process is quite simple. When you wish to apply for a health insurance cover over the Health Insurance Marketplace (marketplace), you will be required to state your income level and the number of people under your coverage. Financial support will be offered depending on the information provided by the individual in aid to the health coverage.

Short Term Health Insurance for Self-Employed Workers

Self employed individuals can benefit from short term health insurance policy as these cover them for specific period of time. Such health policies are usually less costly compared to long term insurance policies but the benefits are rather limited e.g. narrowed plan options and withholding of benefits because of pre-existing conditions.

When Short-Term Medical Coverage Proves to Bee Beneficial

- Short term health insurance is an excellent option for self-employed persons who;

- Being in-between jobs

- Fail to get access to the open enrollment period of the Marketplace

- Have a desire to get covered but only on a temporary basis

- Await Introduction of the higher coverage plan

Non the less, the focus on the benefits of short-term plans may not be relied on when one needs regular medical procedures or if coverage for pre-existing conditions is more warranted.

Best Short Term Plans 2024

Some of the best providers of short term health insurance in the United States for the year 2024 are:

- Pivot Health: Provides built in short term plans that may be modified depending level of coverage or other provisions.

- Everest: Offers lower priced short term health insurance yet has massive coverage of emergency services.

- IHC Group: Providing various short-temprary health plans with affordable premiums, IHC has developed quite a reputation.

How Do Health Savings Accounts (HSAs) Help Self Employed People

HSAs are excellent especially for self-employed individuals with high deductible health insurance policies. HSAs come generated for tax savings reasons whereby you can put some of the money into savings for medical expenses without speeding normal taxable income.

How HSAs Work

HSA stands for a health savings account. A HSA allows tax-free contributions to be made towards it, as long as it is used towards qualified medical expenditure, which is winds up benefitting both the employer and the employee out of exercising moral hazard free HRAs. Contributions towards it, interest on it, as well as amounts withdrawn for expenses which pertain to medicine are all tax privileged, and so HSAs present significant financial advantages to self employed that wish to cut back their expenditure on health.

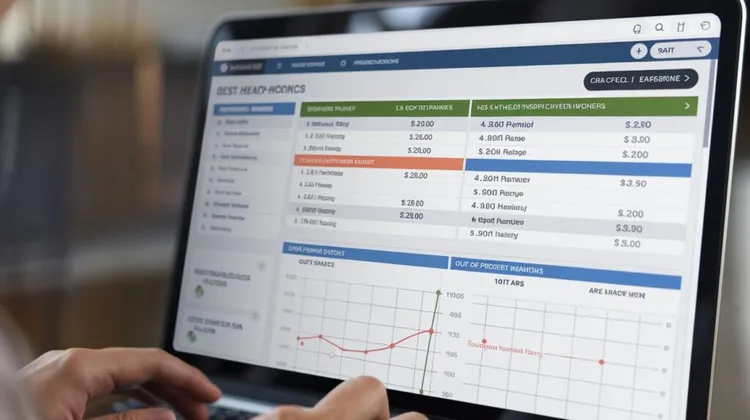

Best Health Insurance Plans for Self-Employed Workers

| Health Insurance Plan | Monthly Premium | Coverage |

|---|---|---|

| Blue Cross Blue Shield (BCBS) | $300 – $500 | Comprehensive health, dental, and vision coverage. Flexible PPO plan with nationwide network. |

| United Healthcare | $250 – $450 | Offers HMO, PPO, and EPO plans. Access to telemedicine services and preventative care coverage. |

| HealthCare.gov (Marketplace Plans) | $200 – $550 | Various plans available depending on income, including subsidies for low-income earners. Essential health benefits included. |

| Aetna | $275 – $475 | Range of health plans with competitive pricing and a large provider network. Options for family plans available. |

Additional Benefits and Features

| Health Insurance Plan | Additional Features | Best For |

|---|---|---|

| Blue Cross Blue Shield (BCBS) | Access to wellness programs, mental health services, and discounts on health-related products. | Self-employed workers who need a large network and wellness support. |

| United Healthcare | 24/7 virtual doctor visits, wellness rewards program, and prescription discount cards. | Those who prefer telemedicine options and extra health perks. |

| HealthCare.gov (Marketplace Plans) | Subsidies based on income, preventive care, and emergency services coverage. | Self-employed individuals eligible for income-based subsidies. |

| Aetna | Mobile app for health management, discounts on fitness memberships, and wellness programs. | Workers looking for a balance between cost and coverage with extra perks. |

Benefits of Combining HSAs with Health Insurance

- Lower Taxable Income: Contributions made in personal accounts decrease the taxable amount, which often lead to favorable net amounts in the taxpayer’s expense.

- Save for Future Medical Expenses: Any money left in an HSA does not get forfeited and in fact, rolls over from year to year in order to allow for the incidence of other HC related expenses at a later date including those that relate to the time investors will have retired.

- Flexibility in Spending: Expenditures out of HSA can be made in several health care endeavors, office visits, drugs, eye and dental care among others.

Health Insurance For Self-Employed Families

For self-employed individuals with housing, it’s essential to seek plans which are affordable and provide the necessary care for the family. Family health insurance coverage includes plans bought from the marketplace which has been established by the ACA and their Surgically installed Diaphragm.

- Best Family Health Insurance Packages With Evaluation CriteriaSome of the best health insurance plans for self-employed families at 2024 includes:Oscar Health: A family angle is well constructed in Oscar Health along with other comprehensive health plans.

- Molina Healthcare: Have cheap plans that cover most families even those with subsidy eligibility.

- Bright Health: Competitive pricing and wellness programs make Bright Health common with families.

Alarming Conclusion With Respect to Coverage For Both Family and For Business

When you want to purchase health insurance and have family members working on self-employment, then it is important that you evaluate for both business and personal health needs. A health insurance structure is therefore sort that accommodates all the family members that remain on focus on the management of the business.

Best Health Insurance As Per The Need

Best health insurance to select as a self-employed worker is a tiring exercise and such, however, through evaluating the particular health needs and the repeating expenses that include finances, making a good decision is possible.

Understanding Individual Possibilities in Terms of Health and Wealth

The first step is to assess your health in the present and predict what kinds of medical treatment you may want during the year to come. If you have chronic medical conditions, or if you foresee that you will utilize many healthcare services, it might be prudent to go for a more developed plan which has lower deductibles and copays.

In reverse, if you are quite well with no chronic diseases and do not foresee a lot of expensive care, a high deductible with a savings account or health spending account (HSA), may be for you.

Making Comparisons in Plan Appropriately

In making some comparisons with health insurance purchasing, it is important that you consider the following aspects:

- Monthly Premiums: Are you in a position to pay for the contributing monthly charge of the plan?

- Deductibles: How much will you spend before your insurance company starts to disburse for your care?

- Out-of-Pocket Maximums: This is the total amount which you will pay for covered services within a given calendar year without exceeding. Upon reaching these costs, the insurance company will take over the entire 100% of all medical costs.

- Coverage Networks: Ensure that you have your required doctors and hospitals on the plans’ network.

Conclusion: Securing the Right Health Insurance Plan for Self-Employed

As a self-employed worker, getting the right health insurance plan is not only crucial for your health but also for your finances. The blue cross blue shield – united healthcare insurance plans with cigna – and Humana health insurance plans. These are the best health insurance plans available for 2024 being that they have plans for everyone including reason with different budgets.

Tailoring the plan in this manner may help you in getting a health plan at a reasonable price which does not limit or skimp on the essential healthcare services.

Frequently Asked Questions (FAQs)

Which is the best health insurance plan for the freelancers?

The two plans often recommended are Blue Cross Blue Shield or Kaiser Permanente as they have reasonable expansive coverage areas and plans.

Can self-employment workers get subsidies to provide health insurance coverage?

Yes, they may obtain subsidies for health insurance opportunities in the website based on self-business income and family size in Marketplace.

Is there cheap health insurance for the self-employed?

Indeed resources such as Marketplace plans with subsidies, high deductible health care plans (HDHP) as well as short term health insurance are able to route such low-priced coverage.

What is the benefit of having an HSA actually?

An HSA gives you opportunity to set aside pre-tax savings for medical expenses which will lower your taxable income and in the long run provide you significant savings on healthcare.

Is it possible for me to get health insurance for my family if I am self-employed?

Yes, self-employed’ can acquire family health insurance through either the Health Marketplace, purchase it from an insurance company or even participate in group insurance schemes for self-employed

What is the way out to go about selecting the most appropriate health insurance plan for self-employed individuals?

Analyze the plans such as premiums, deductibles, out-of-pocket maximums and coverage networks so as to see that the one that meets your care and budget needs is selected.

- Be Respectful

- Stay Relevant

- Stay Positive

- True Feedback

- Encourage Discussion

- Avoid Spamming

- No Fake News

- Don't Copy-Paste

- No Personal Attacks

- Be Respectful

- Stay Relevant

- Stay Positive

- True Feedback

- Encourage Discussion

- Avoid Spamming

- No Fake News

- Don't Copy-Paste

- No Personal Attacks