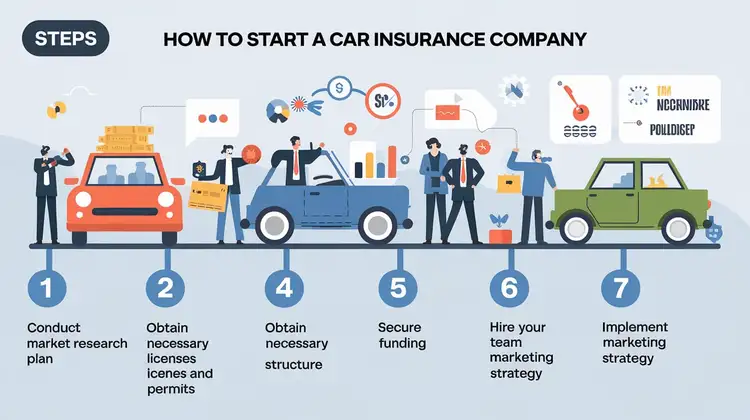

How to start a Car insurance company follow this step

Published: 11 Nov 2024

In order to be successful, it is not only necessary to be knowledgeable about the insurance business, its regulations and policies when setting up a car insurance business, but also, the need to have a proper and logical business plan is very essential. The purpose of this detailed guide is to help you learn all the affairs that will be required in order to start a car insurance business from the ground up.

Analyze The Markets

Before opening a new business, especially in a very competitive business environment like car insurance, a substantial comprehension of the area and the factors in question is ideal. Such would include the trends in the industry, the audience that one intends to reach and the competition in the market. Most companies that deal with car insurance usually concentrate on one market segment, for instance, young drivers who need low-cost insurance or business packages.

Steps to Conduct Market Research:

Determine what the markets require: Figure out the range of factors including the most common types of car insurance policies required by the target market say, liability, comprehensive or uninsured motor insurance.

| Step | Description |

|---|---|

| Conduct Market Research | Analyze competitors, identify customer needs, and find underserved niches. |

| Develop a Business Plan | Create a detailed plan including coverage types, financial projections, and marketing strategy. |

| Meet Legal and Regulatory Requirements | Obtain necessary licenses, meet capital requirements, and comply with insurance regulations. |

| Secure Funding | Raise capital through investors, loans, or reinsurance partnerships. |

Look Into the Competitors: Look into the existing car insurance practices that have been offered by car insurance companies Their prices, level of service and extent of market.

Exhibit Understanding of Regulatory Aspects: Different jurisdictions have their specific legal provisions pertaining to the provision of car insurance policies. Explore the legal requirements that govern the minimum legally required coverages in the areas of concern.

Formulate a Competent Business Plan

A competent business plan should be devised with a business that is looking for investors and funding in mind. It portrays the objectives, approaches and financial projections of a particular business. Ghai and Laghari (2004) claim that a concrete plan can also help in highlighting the USP and marketing strategies.

Some of the Components of Your Business Plan:

Executive summary: This should be a general view of the business car insurance including mission/vision statements.

Industry analysis: Document the findings of your research, emphasizing trends and target audiences. Policies and issues in the research theme: draw conclusions based on the analysis on the specific areas addressed within the trade.

Services and Coverage: Indicate the main coverages to be provided for instance, general liability, collision and/or comprehensive insurance cover.

| Step | Key Tasks |

|---|---|

| 1. Research the Market | Analyze competitors, understand customer needs, and identify gaps in the market. |

| 2. Legal and Financial Setup | Register your company, secure licenses, and ensure you meet capital requirements. |

| 3. Build Your Team | Hire skilled professionals such as actuaries, underwriters, and customer support staff. |

| 4. Develop Your Policies | Create competitive and compliant insurance policies tailored to your target audience. |

Marketing and Sales Strategy: Detail in steps the methods to be used in attracting and retaining customers. This could be through the use of e-election, advertisement or referral schemes.

Financial Plan: Justify the estimates of the expected capital costs, operational income estimates and expected efficiencies. Additionally, such a financial plan has to be realistic and properly substantiated.

Raise Capital

There is a huge capital requirement for starting up the business of providing car insurance, quite a huge amount. Depending on the economies of scale of the business operations, the capital outlay can be in tens of thousands or even in millions. Such amounts will be needed for cost relating to obtaining licenses, office space, employees, promotions and other technological factors.

Ways to Secure Funding:

Personal Savings: One of the very crucial and emerging ways of self sufficiency in starting up your business is targeting personal saving accounts.

Business Loans: On this note, one of the alternatives that can replace this is applying for company loan or small business loans. Especially with a good business plan, this will increase the chances of getting such a loan.

Investors: This means, an alternative would be to seek some angel or venture capitalists who would be willing to invest in the insurance startup.

Crowdfunding: This is also very possible especially where a company has a social cause or is very creative.

Obligations and Participation in the Legal Order

Finally, the market of insurance is composed as a legal monopoly, hence, following through legal mandates is imperative in order to avoid being stripped off the business license and facing other legal sanctions. This is, however, the case with every other industry, each state has its specific foundation, thus certain processes have to be observed depending on the particular state in question.

| Resource | Description |

|---|---|

| Technology Platform | Invest in software for underwriting, claims management, and customer service. |

| Qualified Team | Hire actuaries, underwriters, claims adjusters, and customer support professionals. |

| Reinsurance Partnership | Partner with reinsurance companies to distribute and mitigate risk. |

| Legal Counsel | Work with attorneys experienced in insurance law to ensure compliance. |

Important Compliance Processes and Procedures include:

Licensing: Ensure you apply for relevant licenses with the state’ insurance regulatory body, which usually means the state has to obtain some form of qualification and examinations.

Register Your Business: Make which legal fit for the company, an LLC or a corporation for example and register with the respective State.

Appoint Agents and Brokers: It is highly likely that you will be required to use such qualified persons in the sale of your policies.

Secure Insurance: It is serious that as an insurance provider, one should also provide for his liability exposures.

Enhance the Effective Development of Necessary Insurance Products

This principle describes means of enhancing the cross selling of insurance product lines which every customer care service seeks to do. Your products should of course abide with the legal requirements as well as the consumers’ needs in the region targeted. General car insurance plans include:

- Liability Insurance: Insurance that emphasizes the policies holders liability exposure to damage or injury to third parties, property or members of the public.

- Collision Insurance: Insurance that falls within the perils of loss to the insureds automobile due to an accident.

- Comprehensive Insurance: Insurance covering losses and damages caused by occurrences or incidents which are neither are not collision such as theft or natural disasters.

- Uninsured/Underinsured Motorist Coverage: Insurance coverage for losses sustained from claims of motorists who are insufficiently insured.

- Be innovative and offer coverage options that can be tailored to offer unique coverage to all clients needs.

Create an E-business Reference Facility On The Internet

With change and advancement of technology, the internet is not an option for an insurance provider; it has to be there and standing strong.

Your website must allow prospective clients to have quick quotes, comparisons and purchase the insurance cover with a minimum of frustration. Equally, mobile apps will enhance experience for the customers and help market the organization.

Features of a Good Digital Platform:

- Quote Generator: Let the clients be able to quote the amount by filling in their car and cover information within the minutes.

- Customer Portal: Create a customer panel for policyholders to manage their accounts. Create a customer panel for policyholders to manage their accounts allowing them to fund their accounts and file claims.

- Educational Resources: Put up informative blogs, FAQs and videos to simplify and increase chances of the consumer getting the appropriate insurance cover.

Carry Out an All Inclusive Advertising Plan

In order to reach the clients, they must utilise your services. Their acquisition relies on sound marketing which in the modern day uses internet marketing strategies such as search engine optimization, pay per click and social media marketing.

| Financial Element | Details |

|---|---|

| Startup Capital | Initial funding required for technology, office setup, and regulatory compliance. |

| Operating Costs | Includes salaries, marketing, and ongoing software maintenance. |

| Claim Reserves | Funds set aside to handle customer claims efficiently. |

| Reinsurance Agreements | Cost of partnering with reinsurance companies to mitigate risks. |

Marketing Recommendations:

SEO: Make your website appear to anyone searching for cheap car insurance or the best car insurance companies.

PPC Advertising: Place ads on Google and social media during the April show to advertise your business, as this is when potential clients are looking for car insurance.

Referral Programs: Giving Rabatt or a bonus for a customers’ friends and relatives persuades the existing customers to bring in new ones.

Build Relationships With Other Reinsurers

Reinsurance might well be one of the most significant pillars of the pronounced theory of insurance. It enables one to manage the business risk or exposure through a potential large outflow of funds and hence recurrenct’ business.

Rationale for Reinsurance:

Management of Risk: Re-insuring is a means of distributing risk and having re-insurance with multiple parties can be beneficial in containing adverse risk.

Business Process Strengthening: There are ethical reinsurers who support the business and the way business is carried out is dopes not become a loss.

Create Contact Centres for Customers

The essence of customers and good customer service within an insurance business is necessary given the cutthroat nature of the business in the first place. It should be possible for clients to hold the realistic belief that they are able to reach you whenever they have queries or would want to report a loss.

Suggestions for Customer Support:

- Call Center: In order to facilitate prompt response to queries, modifications to the policies and making of claims, a call center should be established.

- Live Chat: Live chat features on your website should be included in order to increase the speed of customer services.

- Chatbots: Use AI based chatbots to ensure clients are able to perform basic queries and tasks any time of the day.

Assessment and Further Development of Your Business Model

With the inception of your car insurance business, there should be strategic plans on the growth of the company as it operates in an already busy market. Regular monitoring of your business, clients and adversaries can be very critical in ensuring the appropriate changes are made quickly and in a professional manner.

Parameters to Watch:

- Customer Acquisition Cost (CAC): How much is spent in acquiring new customers to your business?

- Customer Retention Rates: How many of the customers that made a purchase opt to renew their policies the year that follows?

- Margin of Profits: Are your income and expenditure balanced to the extent that there would be some profits?

FAQs

How much capital do I need to start a car insurances company?

Amounts between $10,000 to $100,000 or more, depending on the size of the business and location.

Do I need a special licence to start a car insurance company?

Yes, an insurance license must be obtained from the insurance department of the state.

What Types of Car Insurance Should I Provide?

Offer liability, collision, comprehensive and underinsured motorist coverage as these are most commonly sought because of legal requirements.

How do I promote my car insurance firm?

Make use of the internet advertising networks such as SEO, PPC and social networks also use referrals or current clients to promote the business.

What is reinsurance and why do I need it?

Reinsurance is a method of reducing vulnerability to significant uncovered loss through the quarter of risk among different insurers.

Can I start a car insurance company and operate it over the internet?

Yes, many car insurance companies allow their clients to request quotes, administer policies and requests online.

Conclusion

Setting up a business of car insurance is a great deal of stress, a lot of regulation and a really strong business idea. However, these measures when combined with a focus on the needs of customers and modern technology can bring you a decent insurance company ready for the requirements of the contemporary driver.

- Be Respectful

- Stay Relevant

- Stay Positive

- True Feedback

- Encourage Discussion

- Avoid Spamming

- No Fake News

- Don't Copy-Paste

- No Personal Attacks

- Be Respectful

- Stay Relevant

- Stay Positive

- True Feedback

- Encourage Discussion

- Avoid Spamming

- No Fake News

- Don't Copy-Paste

- No Personal Attacks