Home Insurance with the Best Customer Service | Top Picks

Published: 27 Sep 2024

Encryption of Home Insurance

A home insurance policy aims to mitigate the risks associated with home ownership and the movement of our personal effects. It ensures that an individual is compensated for losses that may arise when certain calamities occur. Insurance for the homesite generally takes the forms of dwelling coverage personal property insurance liability insurance and extra living expenses coverage.

The Importance of Customer Service

There is no doubt that good customer service when it comes to the home insurance is paramount. Rarely do those who are impacted by disasters need to spend time looking for an insurer as the demand is quite high and the service responses need proper management. Once you file a claim, the entire process can be very draining. Therefore, a good customer service department can go a long way in relieving the workload. A decent service provider will make sure you know what your options are and which kind of coverage is right for you.

Best Home Insurance for Customer Service

State Farm

State Farm lives up to its name as it provides the best customer service in the insurance industry. The Company provides all covers and in most cases, lots of clients are heard praising how quick the claims take. The Websites and mobile applications are efficient and all policy management is centralized. State Farm has a number of different home insurance policies that include several discounts which make home insurance cheaper.

Key Customer Service Features in Home Insurance Plans

| Customer Service Feature | Why It’s Important |

|---|---|

| 24/7 Customer Support | Having round-the-clock assistance helps policyholders get quick responses for claims, emergencies, or general inquiries. |

| Online Account Management | Accessing your policy, filing claims, and making payments online can save time and increase convenience for homeowners. |

| Quick Claims Processing | Fast and efficient claims processing ensures that you can recover quickly from any damage or loss. |

| Responsive Mobile App | A good mobile app allows easy access to policy information, claims tracking, and real-time assistance, increasing overall satisfaction. |

| Dedicated Claims Adjusters | Having a dedicated professional to guide you through the claims process can improve the experience and ensure accurate settlements. |

| Customer Satisfaction Ratings | High customer satisfaction ratings indicate that the provider is consistent in providing excellent service and handling claims effectively. |

| Live Chat Support | Instant support via live chat can address concerns in real-time without the need to wait on hold for a phone representative. |

Amica Mutual

One of the reasons Amica Mutual can be singled out from other companies is their genuine concern for the satisfaction of every customer. As a result of high marks in regards to ECM policy, the company is adamant about making claims. It is only Matthews that they deal with and not any other person. Moreover Amica has the most reimbursable loyal program, for long term policy holders.

USAA

Especially in military environments, USAA is always remembered as the best when it comes to customer service. The company enjoys a good reputation for providing all possible coverage for its members as well as speedy turnaround of claims made. Special discounts and benefits are available to veterans or active members of the military through USAA.

Nationwide

Nationwide is well-known for issues regarding customer service and customer satisfaction. The company also provides a huge number of home insurance policies that can be customized. Many customers have remarked on the uncomplicated way to claim and the assistance in claiming.

Allstate

Allstate provides an impressive array of home insurance policies and also has great customer care services. With their online tools and resources, customers find it easy to most of the time manage their policies. With Allstate, the process of claiming for compensation is simple and more so they help clients in every stage of the process.

Note down the important aspects when buying Home Insurance.

Comprehensive Coverage’s

Home insurance is an agreement through which a client guarantees to himself a peace of mind in assuring that most risks associated with possession are managed well. There are limits that this policy will include, which may be Policy personal property, Ho6 Policy Dwelling Liability and Additional Expenses incurred by insurance coverage. Policies vary widely and so ensure that you know what exactly is covered in the policy with no other additional or any exclusions.

Affordability

Affordability is another crucial factor to consider. Home insurance premiums can vary significantly between providers. It is advisable to obtain multiple quotes to find the most reasonable rates. Look out for common discounts that may be offered such as when you bundle policies together or even install a security system.

Customer Reviews

Customer reviews can tell you how well customer service is performed in a particular company. Search for company reviews on various sites and try to find out the level of satisfaction or discontent clients have with the services rendered. Concentrate on the reviews about the claims procedure, how fast or responsive they are and if they are supportive.

Claims Process

An effective claims process is important when its time to make a claim and you need one or two strategies on how to do so. Ask how to make claims and how long it usually takes for claims to be attended to. A company that processes claims quickly is a welcome relief when one is going through tough times.

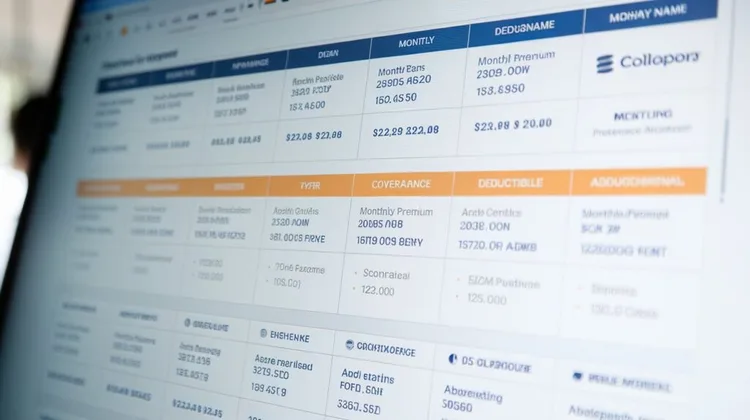

| Insurance Provider | Plan Type | Key Features | Customer Service Rating |

|---|---|---|---|

| Amica | Homeowners Insurance | Customizable coverage, highly-rated mobile app, and discounts for bundling. | 4.8/5 |

| USAA | Homeowners Insurance | Exclusive benefits for military families, highly rated for claims processing and customer support. | 4.9/5 |

| State Farm | Homeowners Insurance | Great customer support, quick claims handling, and robust coverage options. | 4.6/5 |

| Allstate | Homeowners Insurance | Easy-to-navigate app, affordable pricing, and strong customer support. | 4.5/5 |

| Progressive | Homeowners Insurance | Comprehensive coverage options, including flood and earthquake insurance, strong customer service team. | 4.3/5 |

| Liberty Mutual | Homeowners Insurance | Good discounts, user-friendly online platform, and a wide range of coverage options. | 4.2/5 |

| Farmers | Homeowners Insurance | Personalized coverage, reliable claims service, and competitive pricing for bundling policies. | 4.4/5 |

Customer Support

Make sure to also evaluate the level of customer support that the insurance company offers. Look for whether there are available different channels like telephone, email and live chat. Navigating through problems becomes easier thanks to a polite support staff who are always ready to assist whenever there is a need to ask any queries.

Frequently Asked Questions (FAQs)

What is Homeowners Insurance?

Homeowners insurance is a policy specifically designed to protect the house and its content from anticipated calamities like fires, burglary and other damage-causing incidents.

Why is the need of customer service in home insurance explain in detail?

The need of customer service in home insurance is to prevent you from suffering losses or inconveniences when making claims and having queries in relation to the policy that you have.

How do I get a home insurance that is within my budget?

Comparing quotes from various providers would be the best way of finding inexpensive home insurance coverage, looking for discounts and bundling policies.

What should one look for when buying a home insurance cover?

In choosing a particular home insurance policy, look out for values like how wide the coverage will be, how reasonable the price is, customer reviews, the ease of filing the claims and customer service.

What insurance do renters need?

If you are a tenant renting CPH, you probably won’t have a need for a standard homeowners insurance policy, however, doing so makes more sense for safeguarding your assets.

What insurance do renters need?

What you need to remember

It is necessary to select home insurance plans where you can get the best customer service in the year 2024 so that you can secure your investment and anything that brings you peace of mind. State Farm, Amica Mutual, USAA, Nationwide and Allstate are among the companies which provide great insurance offers and maintain good relations with the customers. Advised on the major aspects to look for together with considering the best companies allows one to make smart choices that would address their concerns.

This piece has given a practical approach towards determining home insurance cover with specific regard to customer care. Given the right facts and tools one can choose a home insurance company that makes sure the individual every so often gets the appropriate assistance. Always make a point of checking back on your options every so often to make certain that you have the optimal insurance on your house.

- Be Respectful

- Stay Relevant

- Stay Positive

- True Feedback

- Encourage Discussion

- Avoid Spamming

- No Fake News

- Don't Copy-Paste

- No Personal Attacks

- Be Respectful

- Stay Relevant

- Stay Positive

- True Feedback

- Encourage Discussion

- Avoid Spamming

- No Fake News

- Don't Copy-Paste

- No Personal Attacks