Best How to insure a tiny home parked on rented farmland

Published: 24 Jul 2025

Introduction

In the past few years, the tiny home movement has picked up speed, attracting people who want a simpler, cheaper and greener lifestyle. Although downsizing costs less and shrinks a carbon footprint, owning a compact house still carries thorny hurdles especially when insurance enters the picture. If the home is parked on rented farmland rather than a fixed lot, new legal and physical layers appear that an average homeowner policy was never designed to manage. This article reviews the coverage paths open to renters and owners alike, outlining the blend of personal and property safeguards required in this hybrid dwelling set-up. By weighing each option, readers can select terms that guard against common hazards while keeping premiums affordable.

Why Do Tiny Homeowners Need Insurance for Homes on Rented Farmland?

1. Understanding the Risks of Renting Farmland

Leasing a strip of farm ground introduces liability exposures absent on owned suburban land and standard homeowners coverage frequently excludes them. Problems may arise from heavy machinery, seasonal fertilizer spills, high-speed storms that uproot fences or even a careless neighbor who sets fire to straw. Without tailored renters coverage, the dwelling and its contents are left vulnerable to costly repair bills and lost personal possessions.

Protecting Your Tiny Home and Belongings

Despite their compact size and mobility, tiny homes usually contain pricey electronics, tools and personal items. Insuring the house means that if a storm, fire or theft strikes, you can rebuild the shell and replace what was lost. Most policies also include liability coverage that shields you financially if a visitor is hurt on the parcel you rent.

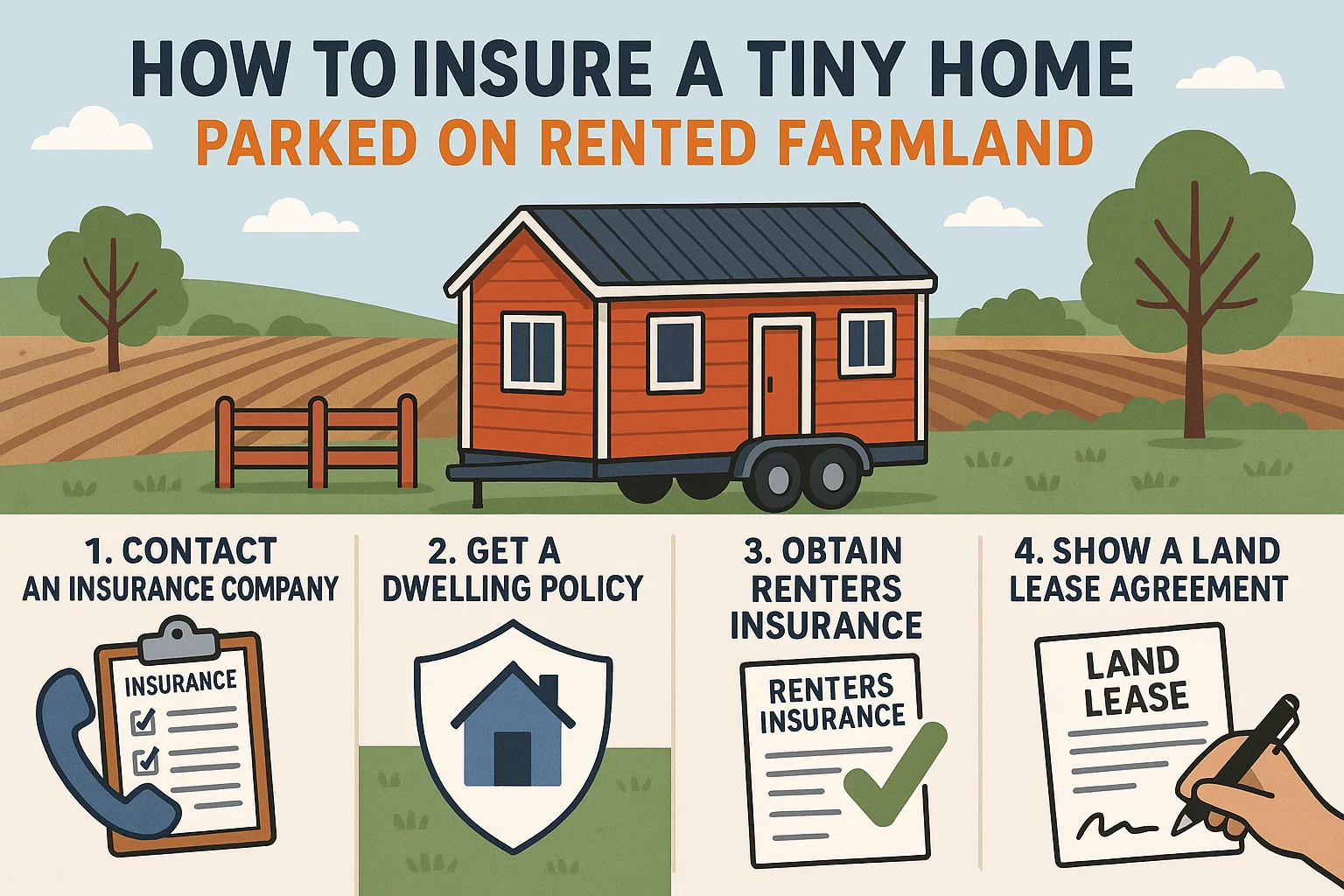

Types of Insurance for Tiny Homes on Rented Farmland

Farmland owners do not typically offer blanket coverage for moving units, so you must hunt down the right policy yourself. Knowing the main products available lets you select the one that aligns with your budget and risks.

1. Mobile Home Insurance (Manufactured Home Insurance)

Because many tiny houses resemble factory-built mobile homes, mobile home insurance is often the easiest fit for owners who camp on leased land. The plan covers both the shell itself and most belongings kept inside, from furniture to solar batteries.

What’s Covered:

Standard policies usually include repair or replacement after collision, wind, hail, fire, vandalism and theft. Liability protection protects you if a passerby trips on the trailer and looks to you for medical bills or damages.

Why It’s Important:

If your tiny house is ruined or badly hurt, mobile-home insurance steps in to pay for repairs or a new unit. This cover is vital for owners parked on rented fields, because it can also address damage caused by the landowner’s work.

2. Tiny Homeowners Insurance

Tiny-homeowners insurance is a niche policy crafted for dwellings that move more easily than average houses and that often stay on wheels. Carriers adjust these plans to fit the particular risks of owners living on leased farmland or in small-micro-communities.

What’s Covered:

Most packages include protection for the home’s shell, the personal gear inside, liability claims that could arise and extra living costs if the unit becomes unlivable.

Why It’s Important:

The policy protects the dwelling from many perils and also gives peace of mind that moving expenses or urgent repairs won’t wipe out your budget.

3. Landlord Insurance for Rented Farmland

When you lease ground for your tiny home, the landowner’s insurance still matters, but keep its limits in mind. Usually, that cover guards only the landlord’s assets and leaves your house and belongings outside its language, so additional coverage on your end remains essential.

What is Covered:

Landlord insurance usually protects the property owner’s buildings and may also address damage your tiny home causes to the surrounding fields or fixtures.

Why it Matters:

Because no two policies are the same, you must read the fine print to see what the landlord covers and which costs fall to you. Unless the agreement is broad enough, you may still want a separate policy that protects your tiny home and its contents.

4. Wide Protection Against Theft and Vandalism

Tiny houses often sit in remote lots where curious passersby are scarce, making them easy targets for theft or vandalism. A broad policy that includes these perils gives you extra peace of mind.

What is Covered:

Such a plan pays for stolen items, repairs to locks and windows and damage inside or outside the shell caused by trespassers.

Why it Matters:

Because tiny homes move, they can be stolen or broken into during short stops. Comprehensive theft and vandalism protection ensures that both the structure and everything inside it have backup when the worst happens.

How to Pick the Right Insurance for a Tiny House Kept on Rented Farmland

1. Determine Your Tiny House’s Replacement Value

First, calculate what it would cost to replace your tiny house if it were damaged or destroyed. Include expenses for lumber, hardware, professional labor, custom fixtures, appliances and any off-grid systems. Knowing this figure confirms that any future policy will pay for a full rebuild instead of a partial one.

2. Decide What Type and Depth of Coverage You Require

Next, list the hazards your home could encounter while parked on the farm or moving between sites. Flooding, wind, theft, fire or simple contractor error may all represent different financial exposures to consider. Your choice of plan—limited homeowners, renters or a specialized mobile unit—will rest on that risk inventory.

Permanent Versus Mobile Protection:

If the house remains on the same lot for months, select a stationary-tiny-home package that treats the building like real property. If you intend to relocate it frequently, add inland-marine or transit protection covering road travel, setup and temporary storage.

3. Choose the Right Deductible

A deductible is the sum you pay out of your own pocket before your insurer contributes anything. Raising that figure usually trims your monthly premium, yet it also forces you to cough up more cash if you file a claim. Pick a deductible that fits your budget so you aren’t blindsided later.

4. Understand the Terms of the Lease Agreement

Scan your lease before you buy any policy. Some landlords spell out the level and type of insurance you must carry while your tiny house sits on their ground. Your coverage must satisfy those demands or you risk losing your spot.

Challenges of Insuring a Tiny Home on Rented Farmland

1. Limited Coverage for Mobile Homes

Finding a suitable policy for a tiny house parked on leased land can be tough because most mainstream carriers ignore them. You will probably have to seek out niche underwriters who specialize in small dwellings and grasp the unique risks you face.

2. Higher Premiums for Tiny Homes

Because tiny houses can move from one place to another, insurers sometimes view them as riskier than fixed buildings and set premiums accordingly. Yet many companies still roll out special packages or loyalty discounts that help keep the cost within reach for owners.

3. Insuring for Land-Based Risks

A policy might protect the structure and guard against theft, but damage linked to the soil, such as floods, erosion or day-to-day farming work, is often excluded. To avoid gaps, owners should review these land-based hazards with their agent and, if needed, add specific endorsements.

FAQs

Yes, coverage is possible, but you will probably need a modified plan—usually called mobile home or tiny homeowners insurance—that wraps up the house, its contents and your liability.

Not usually. Landlord policies protect the rental property owned by the landholder, so the tiny house and any belongings inside require their own standalone insurance.

Insurance premiums for a tiny house parked on leased land depend on the unit’s floor area, overall value, coverage limits and nearby risk factors such as flooding or wind. In general, owners should budget roughly $500 to $2,000 each year.

The right policy hinges on personal priorities and local regulations. Many tiny-home dwellers find that specialized owners-manufactured-home coverage or a bespoke mini-house plan guards both the shell and its contents most completely.

Report any loss to your insurer at once and begin a claim. Gather supporting evidence—snapshots of the harm, receipts for repairs and copies of police or fire reports. Your adjuster will review the file and, under the terms of the contract, either fund repairs or arrange for a replacement unit.

Conclusion

Securing insurance for a tiny house sited on leased farmland in New York—or anywhere else in the United States—can prove tricky because these dwellings do not fit standard real-estate categories. Policyholders must decipher which coverages apply, from personal property to liability and then locate an insurer willing to underwrite such an unusual risk. When the correct contract is finally issued, the owner gains protection against typical hazards such as wind damage, fire loss, theft and third-party claims. Taking time to evaluate individual requirements and collaborating with brokers who specialize in mobile and remote homes thus transforms uncertainty into valuable peace of mind.

- Be Respectful

- Stay Relevant

- Stay Positive

- True Feedback

- Encourage Discussion

- Avoid Spamming

- No Fake News

- Don't Copy-Paste

- No Personal Attacks

- Be Respectful

- Stay Relevant

- Stay Positive

- True Feedback

- Encourage Discussion

- Avoid Spamming

- No Fake News

- Don't Copy-Paste

- No Personal Attacks